Asset appreciation, reasons for it

Central London, income producing retail investments are considered low risk compared to other asset classes, and have the appeal of rental growth and secure long leases.

Savills’ head of commercial research Mat Oakley said: “In a world of uncertainty investors will swing to an income producing and risk off strategy and property will do well from this with prices rising for these assets. The real opportunity is to create long-term secure income producing assets… We believe this is where the best returns will be.”

We continue to see strong demand from retail occupiers, as tenants pursue well-located premises to launch or expand their businesses. The competitive environment for prime space has pushed up rental values. The overall Consulco portfolio has experienced annualised rental growth at an average of 6% and has no vacant retail units.

The London locations that Consulco focus on are areas which we think will be improved by transport links, regeneration and large scale development, therefore offering greater returns once these improvements are completed.

We also expect to outperform average returns through active asset management. We will seek to improve the financial strength of our tenants, secure a change of use and convert to a higher value, psychically extend properties and reconfigure and refurbish.

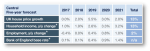

Savills has predicted that average total returns on UK property investments are likely to be approximately 5.6% per annum during 2017-2021, but we expect central London retail investment to exceed this level.

The Hermes fund has achieved 30% return on investment over 6 years.

+44 (203) 214 9940 LONDON

+44 (203) 214 9940 LONDON